Industry specialists expect digitization pattern to proceed after wellbeing emergency closes

Safety net providers expanded their utilization of calamity models, robots and versatile applications during the COVID-19 pandemic, and they envision development in such innovation to proceed with once the wellbeing emergency passes.

Some development in what is known as “insurtech” was driven by the social removing measures and isolates that went with the pandemic, while appropriation of different advancements came notwithstanding it.

Edin Imsirovic, a partner chief at protection rating firm AM Best, said market pressure from the pandemic progressed advancement by a few years or thereabouts.

“Digitization in the insurance space sort of really accelerated this year due to COVID,” Imsirovic said.

That may precisely portray a few advances, for example, discussing essentially with policyholders, said Serge Gagarin, chief of fragment advertising at calamity hazard demonstrating firm AIR Worldwide. In any case, “large-scale systems integration projects,” large ventures guarantors may be attempted, are growing freely of the pandemic, he said.

Innovation development hasn’t generally been a need in the protection business. “We’re a slow industry to adopt things sometimes, I dare say,” said Don Griffin, VP of individual lines for the American Property Casualty Insurance Association.

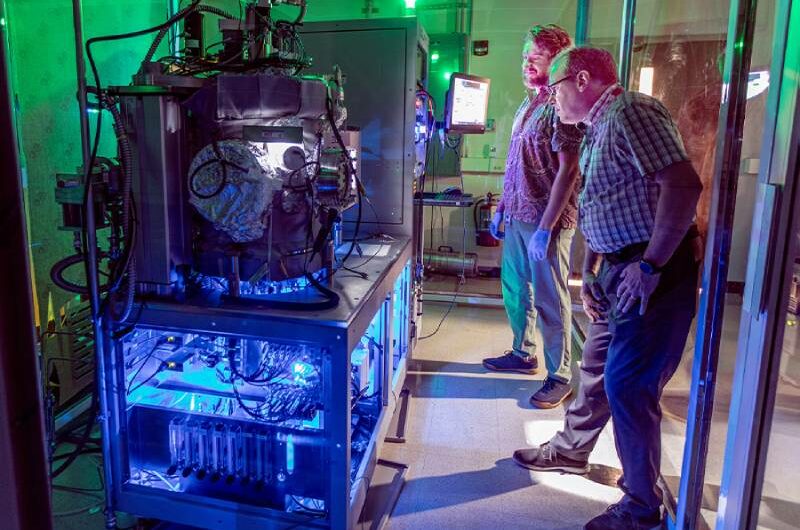

The business has grasped calamity demonstrating for foreseeing the seriousness of occasions and for claims dealing with. Utilization of the innovation was expanding before the pandemic, however it quickened during isolates for claims taking care of, specialists state. This demonstrating gives specialists a thought of how solid harm was at an area, said Tom Larsen, head of industry arrangements at CoreLogic. “Weather forensics” figure out what occurred at a particular area as opposed to a large portion of a pretty far.

“The influence of COVID-19 has been to accelerate this technology, which was sort of moving like a glacier,” Larsen said. Utilizing fiasco demonstrating for claims is better for policyholders since back up plans can deal with claims all the more productively and at a lower cost, getting cash to customers quicker, he said.

Since back up plans don’t cooperate with policyholders frequently, they can separate themselves from different organizations by how they react to clients on occasion of need, Larsen said.

Karen Clark, CEO and prime supporter of calamity demonstrating firm Karen Clark and Co., said fiasco models can be utilized for projecting normal case seriousness in the two days before a typhoon makes landfall. Her organization’s information, which guarantors use for arranging, shows harm by postal district and updates two times every day. After a disaster, guarantors need additional agents, so getting ready for the seriousness of cases can assist them with choosing where to put them, she added.

Models are additionally utilized for misrepresentation location to check whether claims for hail harm, for instance, are coming from zones where tempests didn’t hit. Hail is “the main type of weather that causes insurance claims,” Clark stated, assessing it causes safety net providers more than $15 billion in harm on normal every year, about 33% of which is for business property and individual auto inclusion and the rest for mortgage holders’ inclusion.

Demonstrating for disasters

The utilization of demonstrating for anticipating claims originates from harm displaying, which was flooding before the pandemic. The innovation includes guarantors submitting data to demonstrating firms that can run a large number of situations to foresee likely effects from ruinous occasions.

In the previous quite a long while, storms have been more regular and now and then more extreme. A record 30 named storms, 12 of which made landfall in the U.S., framed during a year ago’s Atlantic typhoon season, as per the National Oceanic and Atmospheric Administration.

Regardless of the quantity of tempests, safeguarded misfortunes were reliable with the drawn out normal dependent on fiasco displaying, so utilizing the models assisted guarantors with being readied, Gagarin said.

Models for flooding and fierce blazes that foresee where harm may happen are on the ascent.

Karen Collins, colleague VP of individual lines at the American Property Casualty Insurance Association, said drones came into broad use after Hurricane Harvey in 2017. As indicated by Clark, they were much more important during the pandemic to help stay away from in-person examinations, for example, when agents hop on rooftops to see harm.

“Certainly drone technology has been used a lot more,” Clark said. “That was coming along anyway, but I know a lot of companies are subscribing to that so they can quickly survey particular houses in the impacted areas to see how many of their policyholders could have roof damage,” which is the most widely recognized in a typhoon. She foresees that pattern will proceed after the COVID-19 pandemic.

Looking forward, back up plans see more innovation development.

One territory is the development of telephone applications, for example, those for starting guaranteeing, Collins said. A few transporters were utilizing them before the pandemic, and some adjusted as a result of it, she said dependent on her own perceptions.

“The insurance industry is very open to embracing new technologies,” Collins said. “Anything that is bringing efficiencies into play, and might even be cost savers that they can, in turn, pass savings on to policyholders to reduce rates, are certainly technologies that the industry’s going to be very receptive to and not just turn off when the pandemic finally concludes.”

Topics #Demonstrating for disasters #insurance production #spurs technology #spurs technology development